Including Anti-Cruelty in your final giving plans allows you to enjoy the benefits of a gift to charity while making a powerful statement about your love of animals while helping us care for and protect animals in need.

Remembering Anti-Cruelty in your will, trust or other estate plans allows us to help hundreds of thousands of animals through our leading-edge programs and services. The Rose Fay Thomas Society is our special way of recognizing those whose planned gifts enable a healthy financial future for our organization and the homeless pets in our care. These gifts are so special because they truly ensure the future of Anti-Cruelty and thousands of animals in need.

We appreciate your support of us through your own estate and planned giving as it recognizes our work to build a community of caring for animals in need.

There are many ways to benefit Anti-Cruelty as you make final giving plans:

- Name Anti-Cruelty as a beneficiary in a will or living trust

- Make a gift of cash or appreciated securities to establish a charitable gift annuity with Anti-Cruelty

- Create a charitable remainder trust or charitable lead trust and name Anti-Cruelty as the beneficiary

- Name Anti-Cruelty as the beneficiary of a paid life insurance policy or a retirement account

- Transfer gifts of stocks, bonds, and mutual funds

To include Anti-Cruelty in your plans, you need the information that follows:

Legal Name: The Anti-Cruelty Society

Legal Address: 157 West Grand Avenue, Chicago, IL 60654

Federal Tax ID: 36-2179814

Type of Organization: Illinois Not-For-Profit Corporation, 501(c)(3) exempt entity

We encourage you to contact your financial advisor and/or attorney for recommendations for your particular situation. We are able to refer you to a professional should you like.

Join the Rose Fay Thomas Society

In 1899 a small group of women joined forces to help abused and unwanted animals in the city of Chicago. Mrs. Rose Fay Thomas spearheaded this effort. By the actions and belief of these incredible women, Anti-Cruelty was founded.

We established the Rose Fay Thomas Society to honor those who have thoughtfully included Anti-Cruelty in their will, trust or other estate plan. It is our special way of recognizing those whose planned gifts ensure a healthy financial future for our organization and the pets in our care. Rose Fay Thomas Society gifts are special because they truly ensure the future of Anti-Cruelty and thousands of animals in need.

Rose Fay Thomas Society Benefits

As a member of the Rose Fay Thomas Society, you will enjoy a deeper connection to Anti-Cruelty. This program is designed to provide you with an overall vision into our long-term plans and to keep you engaged, inspired, and excited about what your future gift will accomplish. The benefits include:

Invitations to:

- Our annual Rose Fay Thomas Society event

- Hands-on mission experiences

- Private tours of our facilities

- Planned giving seminars

- Special events

We are proud to honor our Rose Fay Thomas members, and are so very grateful to those whose realized gifts make possible so many of our life-saving programs and services for animals. Being a Rose Fay Thomas Society member promotes awareness and encourages others to join, although you may choose to remain anonymous. In recognition for your generous plans we will include your name:

- In our annual report, and on our website

- Future, permanent recognition under name of your choice on our bequest wall (once the gift has been received)

- Special invitations to events

To join the Rose Fay Thomas Society, simply notify us of your intentions. Please download our Statement of Testamentary Provision, complete as much or as little of the information as you feel comfortable with and return it to Anti-Cruelty at 157 W. Grand Avenue, Chicago, IL 60654, attention Mission Advancement. While this form is not required or legally binding, it helps us to plan and to understand how you’d like to be recognized.

For any questions regarding the Rose Fay Thomas Society or how to leave a gift to Anti-Cruelty in your will, trust, or other estate plan or to let us know you have already included Anti-Cruelty in your will, trust or estate plan, please contact our Mission Advancement team at development@anticruelty.org or call 312-645-8200.

For any questions regarding the Rose Fay Thomas Society or how to leave a gift to Anti-Cruelty in your will, trust, or other estate plan or to let us know you have already included Anti-Cruelty in your will, trust or estate plan, please contact our Mission Advancement team at development@anticruelty.org or call 312-645-8200.

Download the Rose Fay Thomas Brochure

Leaving Your Legacy

Every planned gift or bequest can help provide for the future of Anti-Cruelty and support its work to care for and protect animals in need.

Remembering Anti-Cruelty in your will, trust or other estate plans allows us to help hundreds of thousands of animals through our leading-edge programs and services. The Rose Fay Thomas Society is our special way of recognizing those whose planned gifts ensure a healthy financial future for our organization and the homeless pets in our care. These gifts are so special because they truly ensure the future of Anti-Cruelty and thousands of animals in need.

We so appreciate your support of us through your own estate and planned giving as it recognizes our work to build a community of caring for animals in need.

Wills or Living Trusts

One way to support Anti-Cruelty is to provide for the organization in your will or living trust. These gifts for the benefit of Anti-Cruelty may be for a specific dollar amount, a percentage of your estate, or the residual amount of your estate after other distributions are made and expenses are paid.

We have partnered with FreeWill to help people build a legacy and help provide future support for Anti-Cruelty's important work to care for and protect animals in need. FreeWill provides a completely free tool that lets you prepare your own will. Creating a planned gift is a powerful way to make a lasting impact that won’t cost you anything today. Writing a will is one of the most important steps to protect what matters most to you and have a plan in place. Get started today by using this FreeWill tool. Contact Development for more information or any questions.

Sample Bequest Language

The following are examples of statements that could be used to prepare a bequest or Trust designation. We would be happy to work with you, your attorney, or your financial advisor to develop specific language to most accurately communicate your wishes.

“I give (the sum of $_______) to The Anti-Cruelty Society; a private, nonprofit 501(c)(3) organization; to be used to further its mission as the Board of Directors, in their discretion, may deem appropriate.”

“I give (the sum of $_______) to The Anti-Cruelty Society; a private, nonprofit 501(c)(3) organization.

This bequest may be combined with the organization’s other funds for purposes of investment and reinvestment and shall be used by Anti-Cruelty in support of (a specific area of interest). If, at any time, in the judgment of the Board of Directors, it is impractical or impossible to carry out this purpose, then the Board of Directors may use this bequest for such other purposes as shall be determined by the Board of Directors to be consistent with my interests and intentions.”

We would be happy to work with you, your attorney or your financial advisor to develop specific language to most accurately communicate your wishes.

For information about specific areas of interest, please contact our development team at 312-645-8200 or development@anticruelty.org.

“I give all of (or a specific percentage of) the residue and remainder of my estate to The Anti-Cruelty Society; a private, nonprofit 501(c)(3) organization; to be used to further its mission as the Board of Directors, in their discretion, may deem appropriate."

Charitable Gift Annuity

Establishing a Charitable Gift Annuity through Anti-Cruelty can provide you with a reliable, consistent source of income for life, while also benefiting the thousands of animals we take in each year.

The amount of the quarterly payment is based on the age of the income beneficiaries at the time of the gift and the date when payment begins. A portion of the income may be tax-free, and a portion of the gift may be claimed as a charitable deduction. Annuity payments may begin immediately or may be deferred for a period of time as part of your retirement plan. We require a minimum $10,000 annuity.

Charitable Remainder Trusts

Naming Anti-Cruelty as a beneficiary of your Charitable Remainder Trust helps provide for our ongoing mission. While Anti-Cruelty cannot establish a Charitable Remainder Trust for you, you may name Anti-Cruelty as the beneficiary of a Charitable Remainder Trust established with a bank, financial institution, or investment firm. Consult your estate planning attorney, financial advisor, or tax advisor for more information.

Charitable remainder trusts allow you to ensure the future fiscal health of Anti-Cruelty while increasing your current income. They are particularly advantageous for appreciated assets and real estate. A uni-trust provides a variable income based on a percentage of the value of the trust assets as determined each year. Charitable remainder annuity trusts are excellent planning vehicles for older donors with appreciated stock. An annuity trust pays a fixed dollar amount each year to the income beneficiary, with the remainder benefiting Anti-Cruelty.

Life Insurance or Retirement Accounts

The gift of a funded life insurance policy or retirement account may enable you to turn a moderate monthly premium into a substantial gift to Anti-Cruelty.

By simply naming Anti-Cruelty as the beneficiary of your paid life insurance policy, 401(k), IRA, TSA or other retirement account, you can make a substantial future gift to benefit homeless animals. Just contact the company that holds these policies or accounts, ask for a beneficiary form, and update it to reflect Anti-Cruelty as the primary or contingent beneficiary. You may leave all or part of these policies or accounts to Anti-Cruelty. Note that, as a direct distribution at your passing, funds from retirement accounts will not be subject to estate tax or to income tax, making the entire balance benefit Anti-Cruelty.

Qualified Charitable Distributions (QCDs)

When planning your IRA withdrawal strategy, you may want to consider making charitable donations through a QCD.

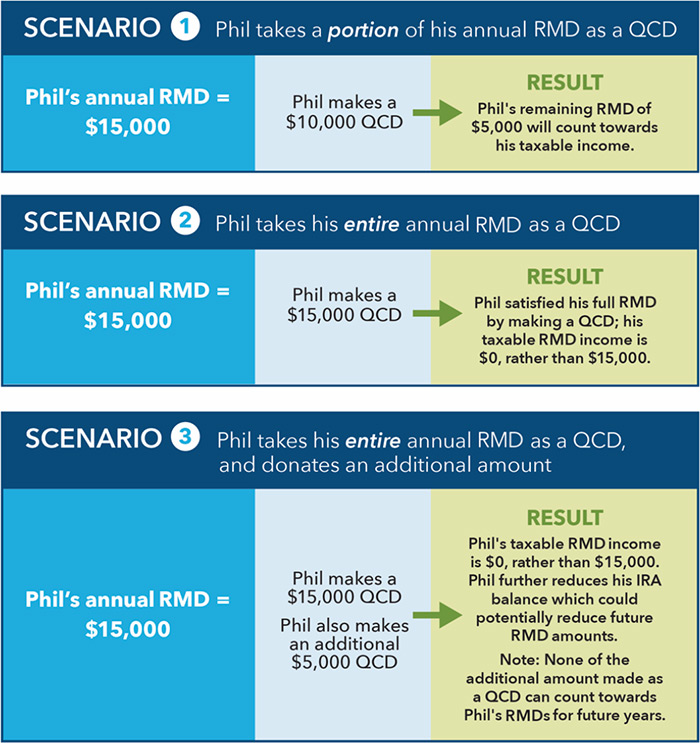

A QCD is a direct transfer of funds from your IRA custodian, payable to a qualified charity. QCDs can be counted toward satisfying your required minimum distributions (RMDs) for the year, as long as certain rules are met. In addition to the benefits of giving to charity, a QCD excludes the amount donated from taxable income, which is unlike regular withdrawals from an IRA. Keeping your taxable income lower may reduce the impact to certain tax credits and deductions, including Social Security and Medicare. Also, QCDs don't require that you itemize, which due to the recent tax law changes, means you may decide to take advantage of the higher standard deduction, but still use a QCD for charitable giving.

CAN I MAKE A QCD?

While many IRAs are eligible for QCDs—Traditional, Rollover, Inherited, SEP (inactive plans only), and SIMPLE (inactive plans only)* —there are requirements:

- You must be 70½ or older to be eligible to make a QCD.

- QCDs are limited to the amount that would otherwise be taxed as ordinary income. This excludes non-deductible contributions.

- The maximum annual amount that can qualify for a QCD is $100,000. This applies to the sum of QCDs made to one or more charities in a calendar year. (If, however, you file taxes jointly, your spouse can also make a QCD from his or her own IRA within the same tax year for up to $100,000.)

- For a QCD to count towards your current year's RMD, the funds must come out of your IRA by your RMD deadline, generally December 31.

- Contributing to an IRA may result in a reduction of the QCD amount you can deduct. (The aggregate amount of deductible IRA contributions you make to your IRA after you turn 70 1/2 will reduce the amount of the QCD that is not includible in your gross income.)

Any amount donated above your RMD does not count toward satisfying a future year's RMD.

Funds distributed directly to you, the IRA owner, and which you then give to charity do not qualify as a QCD.

Under certain circumstances, a QCD may be made from a Roth IRA. Roth IRAs are not subject to RMDs during your lifetime, and distributions are generally tax-free. Consult a tax advisor to determine if making a QCD from a Roth is appropriate for your situation.

HOW DO I TRANSFER A QCD

- For a QCD to count toward your current year’s RMD, the funds must come out of your IRA before the deadline which is December 31 each year.

- Funds must be transferred directly from your IRA custodian to Anti-Cruelty, which is a qualified 501©3 nonprofit. This is done by requesting your IRA custodian issue a check from your IRA, payable to Anti-Cruelty. You can then request that a check be mailed to the Anti-Cruelty at 157 W. Grand Avenue, Chicago, IL 60654 c/o Development, or you can forward the check to the Anti-Cruelty yourself.

- NOTE: If the distribution check is made payable to you, the distribution would NOT qualify as a QCD and would be treated as taxable income.

TAX REPORTING

A QCD is reported as a normal distribution on IRS Form 1099-R for any non-Inherited IRAs. For Inherited IRAs or Inherited Roth IRAs, the QCD will be reported as a death distribution. Itemization is not required to make a QCD. While the QCD amount is not taxed, you may not then claim the distribution as a charitable tax deduction. A QCD is not subject to withholding. State tax rules may vary, so for guidance, consult a tax advisor.

When making a QCD, you must receive the same type of acknowledgement of the donation that you would need to claim a deduction for a charitable contribution.

A tax advisor can help you determine if both your IRA and charity qualify for QCDs.

ANTI-CRUELTY CONTACT INFORMATION

Legal Name: The Anti-Cruelty Society

Legal Address: 157 West Grand Avenue, Chicago, IL 60654

Federal Tax ID: 36-2179814

Type of Organization: Illinois Not-For-Profit Corporation, 501(c)(3) exempt entity

SAMPLE QCD SCENARIOS:

Stocks, Bonds and Mutual Funds

By donating appreciated stocks, bonds, and mutual fund shares that have been owned for more than one year, you can receive an income tax deduction for the fair market value of your gift. To make a stock gift to Anti-Cruelty, please contact the development team development@anticruelty.org or call 312-645-8200.

You can also use our free tool to help complete the necessary paperwork and donate stock to Anti-Cruelty, in 10 minutes or less.

Stock will be transferred to The Anti-Cruelty Society: (bank name)

Bank Credit Account

Account Name

Routing number

Bank house account number

Please contact the development team at development@anticruelty.org or call 312-645-8200 on or before the day you actually initiate the transfer the following information, so that we may acknowledge you and record the gift appropriately:

a. number of shares

b. name and stock symbol of what you plan to transfer

The gift will be valued on the day the stock enters Anti-Cruelty's account.